Diesel Performance Company Acquires $2.5 Million Loan

$2.5 Million SBA 504 Loan

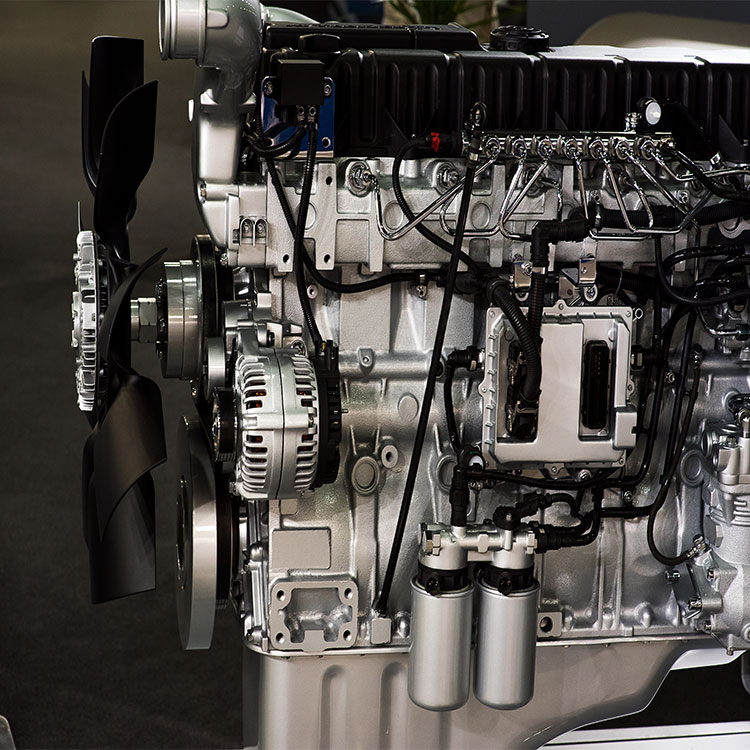

This Denver, CO diesel performance company sought a $2,500,000 SBA 504 refinance transaction. The customer was wrapped up in bank loans that were significantly higher than market averages. Avid Commercial was able to reduce the rate and re-fix the interest rate to something more appealing to the customer. In addition, Avid helped the customer refinance two hard money equipment loans that was having a significantly negative impact on their monthly cash flow.

Contact Avid Comercial Today

Avid Commercial builds agile lending solutions that help entrepreneurs across every industry grow their businesses, invest in their employees, and drive overall corporate success. Contact us today to learn more.